Is GST Registration Mandatory for Freelancers in 2026?

Freelancing is no longer a side hustle—it has become a full-time profession for millions of Indians. From IT consultants and digital marketers to designers, content writers, and financial professionals, freelancers now serve Indian and global clients from cities like Jaipur, Rajasthan.

With growing income and international exposure, one common question arises:

Is GST registration mandatory for freelancers in 2026?

The answer depends on income threshold, type of clients, and nature of services. More importantly, freelancers must also understand the penalties for GST non-compliance, which have become stricter in 2026.

This guide explains GST registration rules for freelancers, practical examples, penalties, compliance risks, and how professional consulting services can help you stay stress-free.

Why GST Compliance Matters for Freelancers in 2026

GST law treats freelancers as service providers, similar to businesses. With enhanced data analytics, bank transaction tracking, and international remittance reporting, tax authorities can easily identify non-compliance.

Business Importance of GST for Freelancers

-

Avoid penalties for GST non-compliance

-

Maintain legal credibility with clients

-

Enable smooth foreign remittances

-

Prevent notices, audits, and registration cancellation

-

Support long-term financial growth

For freelancers availing services in Jaipur, Rajasthan, local GST enforcement has become more systematic and proactive.

Who Is Considered a Freelancer Under GST?

A freelancer is an independent professional who provides services without being employed by a single company.

Common Freelancers Covered Under GST

-

IT & software consultants

-

Digital marketers & SEO experts

-

Content writers & designers

-

Architects & engineers

-

Management & legal consultants

-

Online trainers & coaches

GST law does not distinguish freelancers from businesses—both are treated as “suppliers of services.”

Is GST Registration Mandatory for Freelancers in 2026?General Rule – Turnover Threshold

GST registration is mandatory if your annual aggregate turnover exceeds ₹20 lakh (₹10 lakh in special category states; Rajasthan follows ₹20 lakh).

✅ If turnover is below ₹20 lakh:

GST registration is not mandatory (with exceptions).

✅ If turnover exceeds ₹20 lakh:

GST registration becomes mandatory.

Situations Where GST Registration Is Mandatory Regardless of Turnover

Even if your income is below ₹20 lakh, GST registration is compulsory in the following cases:

1. Freelancers Providing Services to Foreign Clients

If you provide services to clients outside India (export of services):

-

GST registration is mandatory

-

LUT (Letter of Undertaking) required

-

Zero-rated supply (no GST charged, but compliance needed)

📌 Example:

A Jaipur-based freelance web developer working with US clients must obtain GST registration even if earnings are ₹5 lakh.

2. Freelancers Receiving Payments in Foreign Currency

Foreign inward remittances reported through banks automatically trigger GST scrutiny.

3. Freelancers Registered on E-Commerce Platforms

Platforms like freelancing marketplaces may require GST compliance.

4. Voluntary GST Registration

Many freelancers opt for GST registration voluntarily to:

-

Claim ITC

-

Appear professional to corporate clients

-

Avoid future compliance shocks

GST Registration in Jaipur for Freelancers – Step-by-StepStep 1: Eligibility Check

Assess turnover, client location, and service type.

Step 2: Documentation

-

PAN & Aadhaar

-

Address proof

-

Bank details

-

Business proof (if any)

Step 3: Online GST Application

Submit GST REG-01 with correct details.

Step 4: GSTIN Allotment

GST number issued after verification.

Step 5: Post-Registration Compliance

Return filing, invoicing, and record maintenance.

Professional help ensures error-free registration.

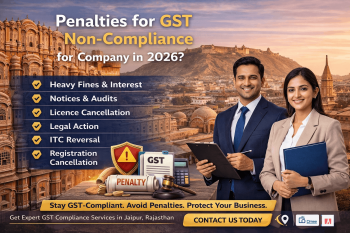

Penalties for GST Non-Compliance for Freelancers

This is where most freelancers face trouble.

Common Penalties Applicable in 20261. Penalty for Non-Registration

-

10% of tax due

-

Minimum ₹10,000

-

100% of tax in fraud cases

2. Late Filing of GST Returns

-

₹50 per day (₹20 for NIL returns)

-

Interest at 18% per annum

3. Wrong ITC Claims

-

Interest + penalty

-

Possible audit or notice

4. Incorrect Invoicing

-

Penalty up to ₹25,000 per invoice

These penalties for GST non-compliance apply equally to freelancers, MSMEs, startups, and companies.

Penalties GST for MSME vs Freelancers – Key Insight

Many freelancers assume MSMEs get leniency. While procedural relief may exist, penalties still apply for non-compliance.

Freelancers transitioning into MSME registration must align GST and Udyam data correctly.

GST Non-Compliance Penalties for Startup and Company – Why Freelancers Should Care

Freelancers planning to:

-

Raise funding

-

Convert into startups

-

Form companies

Must maintain clean GST records. Past non-compliance can:

-

Block funding

-

Delay incorporation

-

Trigger retrospective penalties

Certification and Licences Linked With GST

Freelancers often ignore compliance alignment across:

-

GST Registration

-

MSME (Udyam) Registration

-

Import Export Code (IEC)

-

Professional tax (where applicable)

Mismatch across certifications and licences is a common trigger for GST notices.

Common GST Mistakes Freelancers Make

-

Assuming GST is not applicable

-

Ignoring foreign client GST rules

-

Missing NIL return filing

-

Incorrect invoice format

-

No professional review

These mistakes directly lead to GST non-compliance penalties.

Benefits of Professional GST Consulting for FreelancersWhy Expert Support Matters

-

Correct applicability assessment

-

Zero-error GST registration

-

Return filing & compliance

-

Penalty and notice handling

-

Strategic tax planning

Freelancers using GST services in Jaipur, Rajasthan benefit from local expertise and faster resolution.

Internal Linking Suggestions (For SEO)

-

GST Registration Services

-

GST Return Filing Services

-

MSME Registration Services

-

Startup Tax & Compliance Advisory

-

Business Compliance Blogs

FAQs – GST Registration for Freelancers in 20261. Is GST mandatory for freelancers earning below ₹20 lakh?

Not mandatory unless providing services to foreign clients or specific cases apply.

2. Do freelancers need GST for foreign clients?

Yes, GST registration is mandatory for export of services.

3. What are penalties for GST non-compliance for freelancers?

Penalties include fines, interest, registration cancellation, and legal action.

4. Can freelancers voluntarily register for GST?

Yes, voluntary registration is allowed and often beneficial.

5. Is GST registration required in Jaipur specifically?

GST law is pan-India, but enforcement is active in Jaipur, Rajasthan.

6. Can GST registration be cancelled for freelancers?

Yes, due to repeated non-compliance or incorrect filings.

Conclusion: GST Registration for Freelancers in Jaipur, Rajasthan

In 2026, GST compliance for freelancers is no longer optional or ignorable. Whether you work with Indian clients or global businesses, understanding GST rules and avoiding penalties for GST non-compliance is essential.

Freelancers operating in Jaipur, Rajasthan must stay proactive to protect income, reputation, and future growth opportunities.

Call to Action

Unsure whether GST registration applies to you as a freelancer?

Avoid penalties, notices, and confusion.

👉 Contact our expert GST consultants today for reliable GST registration, compliance, and advisory services in Jaipur, Rajasthan—and focus on growing your freelance career with confidence.